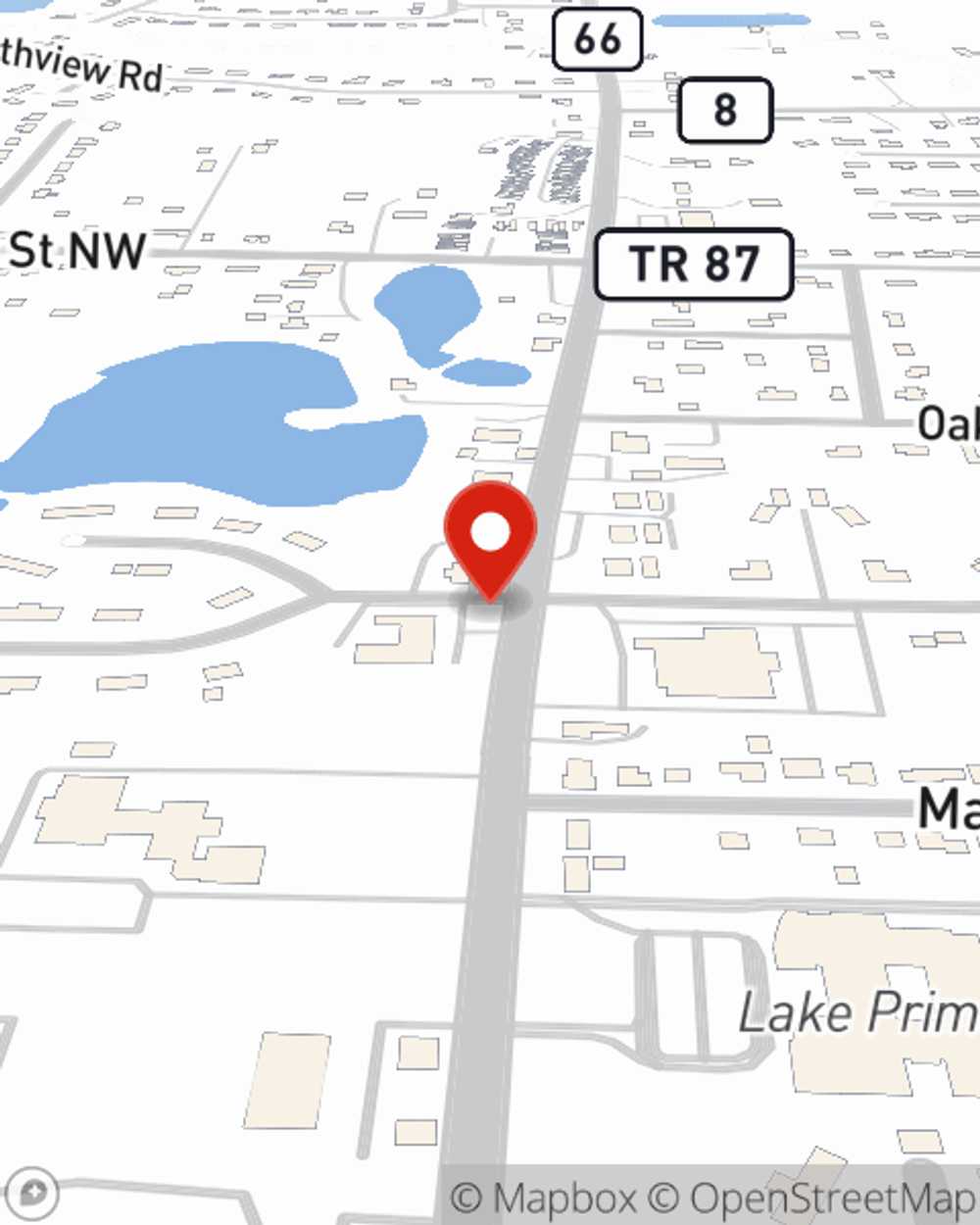

Life Insurance in and around Uniontown

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Uniontown, OH

- Canton, OH

- Lakemore, OH

- Summit County, OH

- Stark County, OH

- Ellet, Akron, OH

- Portage County, OH

- Hartville, OH

- Mogadore, OH

- Ohio, US

Protect Those You Love Most

It can be a big responsibility to take care of your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can maintain a current standard of living and/or keep paying for your home as they grieve your loss.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Wondering If You're Too Young For Life Insurance?

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep your family members safe with a policy that’s modified to accommodate your specific needs. Luckily you won’t have to figure that out by yourself. With deep commitment and outstanding customer service, State Farm Agent Mindy Covington walks you through every step to set you up with a plan that covers your loved ones and everything you’ve planned for them.

Interested in seeing what State Farm can do for you? Visit agent Mindy Covington today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Mindy at (330) 699-3084 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Mindy Covington

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.